Articles

Two of the current and you may famous promotions have been first brought to the public’ focus through RedFlagDeals; Reed and that i were each other in a position to take advantage of these types of campaigns. Western Express is not responsible for maintaining or overseeing the precision of data on this website. To own complete info and you may latest equipment advice click on the Apply now hook up.

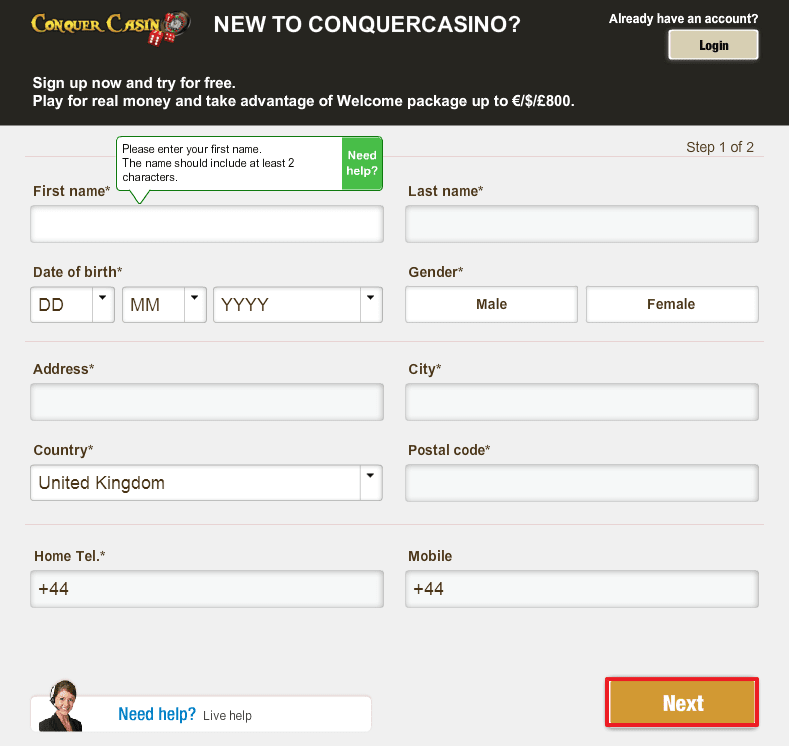

- You might make the most of these offers when you indication-right up for another local casino account.

- For individuals who’re also concerned with lender costs, a no-payment account as opposed to an advertising provide is generally worth the said.

- Consequently from the 2028, 22.six million Brits (43percent) are certain to get a digital-merely checking account.

- In a nutshell, it was an informed bank account sign-upwards venture I’ve but really when deciding to take advantageous asset of within the Canada.

New clients trying to discover an HSBC account can look forward to help you a number of different financial promotions. The newest Ascent is actually a Motley Fool service you to cost and you will ratings very important points to suit your everyday currency things. A knowledgeable lender bonuses and offers have strong a lot of time-label advantages as well as tall really worth. When you get the hang of it, delivering signal-upwards bonuses is going to be a great way to make more cash with just minimal effort. The brand new also provides are constantly altering, so make sure you stick to greatest away from venture termination dates.

目次

Aspiration Bank Extra: $two hundred For brand new People: book of ra uk

A keen HSBC Biggest Checking account brings book of ra uk customers that have use of the lending company’s really popular services. People deals past this can bear a good $.fifty costs. In case your $two hundred bucks incentive provide didn’t a bit take the imagination, then you’re also lucky as the HSBC Financial United states of america is actually giving the new membership people the ability to favor the incentive.

St Lender: Get up In order to $600 Having First Organization Savings account Oh, Pa

If you plan to start a chequing membership, it pays to select you to with an aggressive intro render — virtually. You can discover dollars, 100 percent free merchandise, advertising prices for the most other financial items or perhaps the possibility to waive from bank card charges. You may have to do an account activity or exchange so you can receive the render. A financial sign-upwards bonus try a monetary incentive provided by banking companies and you will borrowing unions so you can prompt people to open an alternative membership. For an advantage, you’ll constantly need possibly see a minimum deposit needs or found being qualified direct places. Bank out of The united states’s $a hundred render generated our set of finest lender incentives as the criteria to make the bonus is relatively easy in order to meet.

Distinguished Credit card Advertisements

It is a fascinating online casino since it provides a library of popular gambling games and you can big incentives and tourneys. Should you choose try the luck scoring greeting bonuses because of the beginning several account, it’s important to know that your’ll are obligated to pay taxes for the anything gained because of these types of join incentives. As well as, particular banks usually disqualify you from an advantage render for those who’ve hit a poor harmony in past times.

A customized line of credit, at the mercy of borrowing from the bank recognition by the National Bank. Compare our choices for an educated scholar savings account to choose the right one to you personally. Internationally renowned writer Henri Ojala has invested more than 10 years mastering the new ins and outs of the fresh playing world, focusing on internet poker, sports betting, and you may online casino games.

Is actually Family savings Bonuses Worth every penny?

But you’ll must earn one aggressive APY by finding electronic statements, that have an automatic fee otherwise lead deposit per month and you can and make at least $five hundred worth of month-to-month debit card purchases. Bonuses and advertisements to the all types of services including as the put points, checking accounts, and credit cards have satisfaction standards and you will issues that must be satisfied. However some online financial institutions offer an excellent chequing membership without monthly commission, really higher financial institutions charge between $cuatro in order to $29 monthly. Possibly, when it comes to a leading everyday balance, which commission is actually waivable.